Newsletter #5

The Federal Reserve cut interest rates, impact of Trump's immigration ban, China's economic slowdown, and more.

The Federal Reserve Slashes Interest Rates

Image Source: Link

Summary: For the first time since March 2020, the Federal Reserve cut interest rates. The reserve axed the rate by half a percent, in the 4.75 to 5 percent range, citing good progress on inflation and balancing risks as the reason why. After a 40-year high inflation in 2022, the economy seems to be moving towards a better place. Due to the aggressiveness of the cut, home buyers, auto loans, and credit car loans are all poised to benefit from the rate cut. But, housing affordability will remain an issue, due to limited supply, and rising prices.

Consumer Analysis: The aggressive rate cuts suggest the US economy is moving towards a good place, and fully rebounding from the downturn from Covid-19. Although the cuts should positively impact loans, consumers won’t feel the impact of the rate cuts for at least a few months. Also, most people with mortgages won’t benefit because over 90% of people have fixed-rate loans. The cutting of interest rates is more made to benefit large companies and big banks that borrow large amounts of money, but the cuts over time should also benefit consumers who are borrowing in the economy.

Source: Al Jazeera | The US Fed cut interest rates by more than expected.

Cooling US Inflation

Image Source: Source

Summary: The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index, has indicated that inflation cooled overall in June. The annual increase was 3%, down from 3.3% in May. Core PCE, which excludes volatile food and energy prices, rose by 4.1% compared to a year ago and showed a slight decrease from the previous month’s 4.6%. The inflation cooling is seen as positive for the Federal Reserve as it suggests that their efforts to control inflation through high interest rates are working.

Consumer Analysis: Cooling inflation can ease the financial strain on households by making everyday items more affordable. As inflation slows, there’s potential for lower interest rates, reducing costs for mortgages, loans, and credit cards. This environment can boost consumer confidence and spending power. Staying informed on these trends helps consumers make smart financial decisions, like when to buy big-ticket items or refinance existing debt.

Source: NYT | Fed’s Preferred Inflation Measure Cooled Overall in June

US Economic Growth

Image Source: Source

Summary: The U.S. economy grew at an annual rate of 2.4% in the second quarter of the year, surpassing economists’ expectations and indicating resilience despite high interest rates. The primary drivers of this growth were robust consumer spending and strong business investments, which together offset the dampening effects of tiger monetary policy. While high interest rates were expected to slow down economic activity, the actual economic performance showed surprising strength, with continued spending in both consumer and business sectors. Key indicators like the gross domestic product (GDP) have reflected this growth and the unexpected growth has led to adjustments in economic forecasts, with some analysts now predicting that the U.S. might avoid a recession if current trends continue. Financial markets have responded positively to this news, with expectations that the Federal Reserve might take a more measured approach to future interest rate hikes given the resilient economy performance.

Consumer Analysis: Strong economic growth is good news for consumers, indicating job stability and potential wage increases. With robust consumer spending driving the economy, people may feel more confident in making significant purchases. The positive market response suggests a favorable environment for investments, and if the Fed eases interest rate hikes, borrowing costs could remain stable, benefiting those with loans or looking to finance big buys.

Source: NYT | U.S. Economic Growth Accelerates, Outpacing Forecasts

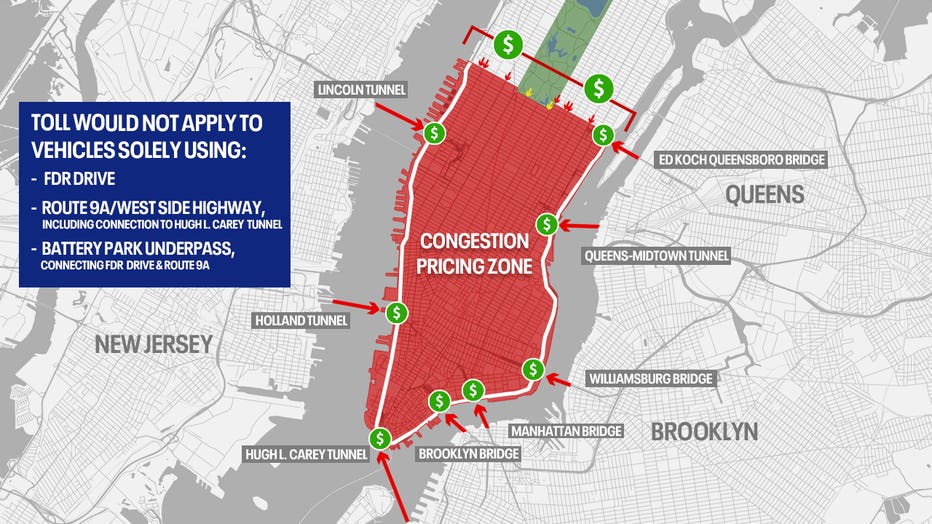

NYC Congestion Pricing Plan

Image Source: Source

Summary: The main objectives of congestion pricing are to alleviate traffic congestion and improve air quality by encouraging the use of public transportation. In New York City, the plan involved charging a toll for vehicles entering the Congestion Relief Zone in Manhattan. Toll rates would vary based on vehicle type, time of day, crossing credits, and payment method, with passenger vehicles charged $15 and small trucks $24. While the program aimed to generate $1 billion in revenue for the MTA to enhance transit and signal reception, it raised concerns about the impact on local businesses, particularly in areas like Chinatown, where many businesses were already struggling post-COVID-19. The additional cost and difficulty of reaching these businesses could have further hindered their recovery.

Consumer Analysis: For consumers, congestion pricing could mean higher costs and reduced convenience when driving into Manhattan. This might encourage more people to use public transportation, potentially easing traffic and improving air quality. However, the added toll could make supporting local businesses in affected areas like Chinatown more challenging, especially for customers who rely on driving. Balancing these factors is crucial for consumers as they navigate the benefits of reduced congestion with the potential drawbacks for local commerce.

Source: ABC7 New York | Congestion pricing plan

Small Stocks Better Than Tech Stocks?

Image Source: Source

Summary: Recently, the stock market has seen a significant shift. Technology stocks, particularly those linked to AI, have driven major index gains worldwide, rising faster than any other sector. However, concerns about the sustainability of this tech boom are emerging as the Federal Reserve plans to lower interest rates to boost spending and the economy. Analysts believe this could reduce the dominance of tech companies. On July 11th, the Russell 2000 had its best day of the year, with about $10 billion flowing into small company funds by July 17th. Analysts predict that the exceptional stock-price performance of the past year may not continue, with other sectors likely to catch up due to lower borrowing costs. Some, however, believe that tech will remain dominant, arguing that tech stocks won’t decline as sharply as they rose, thus not dramatically impacting the market.

Consumer Analysis: For investors, the shift in the stock market suggests a need to diversify beyond technology stocks. While tech has driven recent gains, the potential for lower interest rates may boost other sectors, offering new opportunities. Keeping an eye on market trends and adjusting portfolios accordingly can help mitigate risks and capitalize on emerging growth areas.

Source: NYT | Tech Stocks Are Out. Small Stocks Are In. Can That Last?

Job Growth but High Unemployment Rate

Image Source: Link

Summary: The Labor Department reported 206,000 jobs added in June, marking the 46th consecutive month of job growth. However, the unemployment rate rose from 4% to 4.1%, the highest since November 2021. Wage gains have been moderating but have outpaced inflation for about a year. With signs of a slowing job and wage market, economists expect the Federal Reserve to ease credit conditions. Most job gains were in health care, social assistance, and government, while manufacturing and retail lost jobs. Despite the resilient job market and slowing inflation, U.S. households continue to spend, supported by savings from the pandemic. The Federal Reserve’s upcoming decisions will impact the sustainability of the current economic expansion.

Consumer Analysis: For consumers, the increase in job growth and moderating wages suggest a stable economic environment, though the rise in unemployment hints at potential challenges. With expectations of the Federal Reserve easing credit conditions, borrowing may become cheaper, benefiting those looking to finance major purchases. Continued healthy spending levels among households indicate consumer confidence, but staying informed about Federal Reserve decisions will be crucial for future financial planning.

Source:NYT | U.S. Job Growth Extends Streak, but Signs of Concern Emerge

China’s Economic Slowdowns Continue

Image Source: Link

Summary: China's economy has slowed, with Q2 2024 GDP growth at 4.7%, down from 5.3% in Q1, marking the lowest growth since Q1 2023. Retail sales in June rose only 2%, the smallest increase since December 2022, with declines in apparel, cosmetics, and autos. Industrial production increased by 5.3%, driven by non-ferrous metals, chemicals, and non-auto transportation equipment. Government-funded infrastructure projects boosted fixed asset investment by 3.9% in the first half of 2024, while private sector investment grew just 0.1%. Property investment dropped 10.1% annually in June, with falling house prices in 64 of 70 major cities impacting household spending and wealth. Despite positive domestic factors, a government spokesman cited an unstable external environment as a challenge. Economists are debating the best policy approach to balance output growth and boost domestic demand.

Consumer Analysis: The slowdown in China's economy may affect global markets and consumer confidence. With reduced retail sales and property investment, consumers might experience lower household wealth and spending power. However, increased industrial production and government infrastructure projects could provide some economic stability. Keeping an eye on China's economic policies and market responses can help consumers and investors make informed decisions in a potentially volatile environment.

Source:Deloitte | Chinese weak demand persists, more talk about stimulus

Economic Impact of Trump’s Proposed Immigration Ban

Image Source: Link

Summary: According to US news at the Republican National Convention last week, before a crowd of thousands bearing signs reading “Mass deportation now!”, among other slogans, former President Donald Trump pledged to end what he called the “greatest invasion in history” taking place at our southern border. Trump's plan is to deport most of the more than 10 million immigrants lacking proper legal documentation in the United States, by using the military and police to send them to camps and quickly evict them. He claims this would reduce crime and open up more jobs, and higher paying ones, for U.S. born Americans. Several workers in the US believe illegal immigrants have contributed 12 billion dollars to Social Security annually. These policy changes will soon be implemented by most likely Trump if won however not very likely if democrats win as they support immigrants much more as a whole. The question between rules and trust, which one to believe in more and the differences between these 2 parties ideologies will surely have a significant impact on the economic policy implemented to affect Americans.

Consumer Analysis: Trump has been very vocal throughout these past couple decades about his stance on immigration, his opinion does not budge and the consumer will make an effective political decision based on simply that fact at its very pinnacle. Additionally the following policy would impact many businesses with immigrants, even if they were unaware of them being illegal. This policy has an impact on not only immigrants but the greater half of international relations, ethical concerns and economy. Consumers will most likely act based on party identification regardless of personal disputes playing the delegate role.

Source: US News | Trump's immigration ban policy: Economic Shockwaves