Newsletter #6

Featuring stories about: Trump's China tariffs, small business inflation, the Department of Government Efficiency, and more!

Dear Reader,

Welcome back to the sixth edition of The Economic Literacy Initiative Newsletter. As always, you will find insights on current economic events. We have decided to reduce the number of stories to 5-6, to ensure quality and maximum understanding from you, our readers. Also, look out for our Giving Tuesday campaign(December 3rd/this Tuesday), and make sure to donate or share with someone who can. Make sure to share this online, and with friends and family. Happy reading!

Trump’s China Tariffs

Image Source: Link

Summary: Higher tariffs on Chinese goods might sound like a bold strategy, but they could end up backfiring—raising prices for consumers without solving the U.S. trade deficit. That’s the message from Wang Shouwen, China’s Vice Commerce Minister, who explained that slapping a 60% tariff on Chinese imports would only push up costs for Americans while doing little to fix trade imbalances. Tariffs act like taxes on imported goods, making everyday items—from electronics to clothes—more expensive. They also contribute to inflation, driving up prices across the board. Despite these challenges, China remains confident in its ability to handle the pressure, pointing to its $5 trillion in foreign trade this year alone. China’s message is clear: cooperation is key. Wang emphasized the benefits of stable economic relations between the two countries, which would help prevent costly disruptions for businesses and consumers alike. Still, experts warn that steep tariffs could take a serious toll on China’s economy, slashing growth forecasts by nearly half. This comes as China grapples with internal issues, including a weak property market, youth unemployment, and mounting local government debt. The big picture? Trade wars rarely lead to clear victories. Instead, they can disrupt economies, slow growth, and leave consumers footing the bill.

Consumer Analysis: Tariffs are like taxes on goods coming from other countries, and when they go up, so do the prices of everyday items. Many things you rely on—like phones, clothes, and electronics—come from China, so higher tariffs mean you’ll pay more at the store. Over time, these costs can add up, making everything from shopping to groceries more expensive. In short, trade battles can hit your wallet hard, even if they seem far away.

Source: Trump’s 60% tariffs will ‘backfire’ on US and drive up prices, China warns - al.com

Fed Balancing Act: Lower Rates, But Slowly

Image Source: Link

Summary: Federal Reserve Chair Jerome Powell signaled that while interest rates are expected to decrease, the pace will remain cautious. With inflation cooling and the labor market slowing, Powell emphasized moving toward a neutral policy, meaning borrowing costs won’t drop too quickly. Holding rates high risks increasing unemployment, but sudden rate cuts could destabilize inflation control. Inflation data for October showed a slight uptick, rising to 2.6% from 2.4%, partly due to base effects—distortions that occur when current data is compared to unusual numbers from a year ago. Powell remains optimistic about inflation’s downward trajectory, though he acknowledges potential bumps along the way. Trump’s proposed economic policies, like extending tax cuts and imposing tariffs, could reignite inflation and force the Fed to reconsider rate hikes. Powell stressed the importance of maintaining the Fed’s independence, ensuring decisions are based on data and not politics.

Consumer Analysis: The Fed's decision to slowly lower interest rates means borrowing could get a little cheaper, but don’t expect big drops right away. While inflation is cooling, base effects (comparing this year’s data to last year’s unusual prices) make recent inflation numbers look higher than they actually are. If inflation picks up again, like it might with new policies from President-elect Trump, the Fed could raise rates again. For consumers, this means things like loans, credit cards, and mortgages might stay expensive for longer, keeping your monthly costs higher than you'd like.

Source: Fed’s Powell: Rate cuts are still underway, but there’s no hurry | CNN Business

Small Business Inflation

Image Source: Link

Summary: Enjou Chocolat, a small business in Morristown, New Jersey, has raised prices multiple times due to inflation, leading to customer complaints. While inflation has decreased from 2022's highs, small businesses like Enjou Chocolat still feel the impact of rising costs for ingredients and labor. Many small business owners are hesitant to increase prices, but they are forced to do so to cover higher expenses. Despite consumer frustration, holiday spending is expected to rise, with many Americans still planning to support small businesses. However, small retailers face challenges competing with larger stores that can offer broader price cuts.

Consumer Analysis: For consumers, the rising prices at small businesses like Enjou Chocolat may feel like a personal burden, especially after experiencing years of inflation. While the shop's price hikes are a direct response to increased labor and material costs, some customers may perceive these increases as price gouging, which could lead them to seek more affordable alternatives. This resistance to higher prices is seen across the retail sector, as consumers are becoming more selective, shifting from premium products to more cost-effective options. However, despite this pushback, many consumers still show a strong commitment to supporting local businesses, particularly during the holiday season. Small businesses, though squeezed by inflation, can tap into this, hoping that customers will balance their cost concerns with a desire to help community-based shops.

Source: Small businesses are hurting at the worst possible time | CNN Business

Wholesale Price Increases

Image Source: Link

Summary: Wholesale prices increased by 0.2% in October, aligning with expectations, as the producer price index (PPI)—which measures the prices producers receive for their goods and services—indicated inflation is moderating despite remaining above the Federal Reserve's 2% target. Core PPI, excluding food and energy, rose 0.3%, driven by higher service prices like portfolio management, while food and energy prices declined slightly. Markets largely anticipate the Fed to implement another rate cut in December following prior reductions, with easing expected to slow through 2025. Additionally, unemployment claims fell to 217,000, signaling a continued moderation in layoffs.

Consumer Analysis: The October PPI data reveals a nuanced impact on consumers, as modest wholesale price increases signal a potential stabilization of inflation. With the PPI rising by 0.2%, consumers may experience less pronounced price hikes in finished goods, particularly since declining food and energy prices could take off pressure on household budgets. However, the 3.6% surge in portfolio management services highlights the continued burden of rising costs in specific service sectors. While inflation remains above the Federal Reserve's 2% target, easing trends could boost consumer confidence, especially with expectations of further interest rate cuts to stimulate economic activity. Ultimately, steady wholesale prices and declining unemployment claims provide an optimistic outlook for consumer purchasing power.

Source: Wholesale prices rose 0.2% in October, in line with expectations

Impact of Newly Formed Department of Government Efficiency

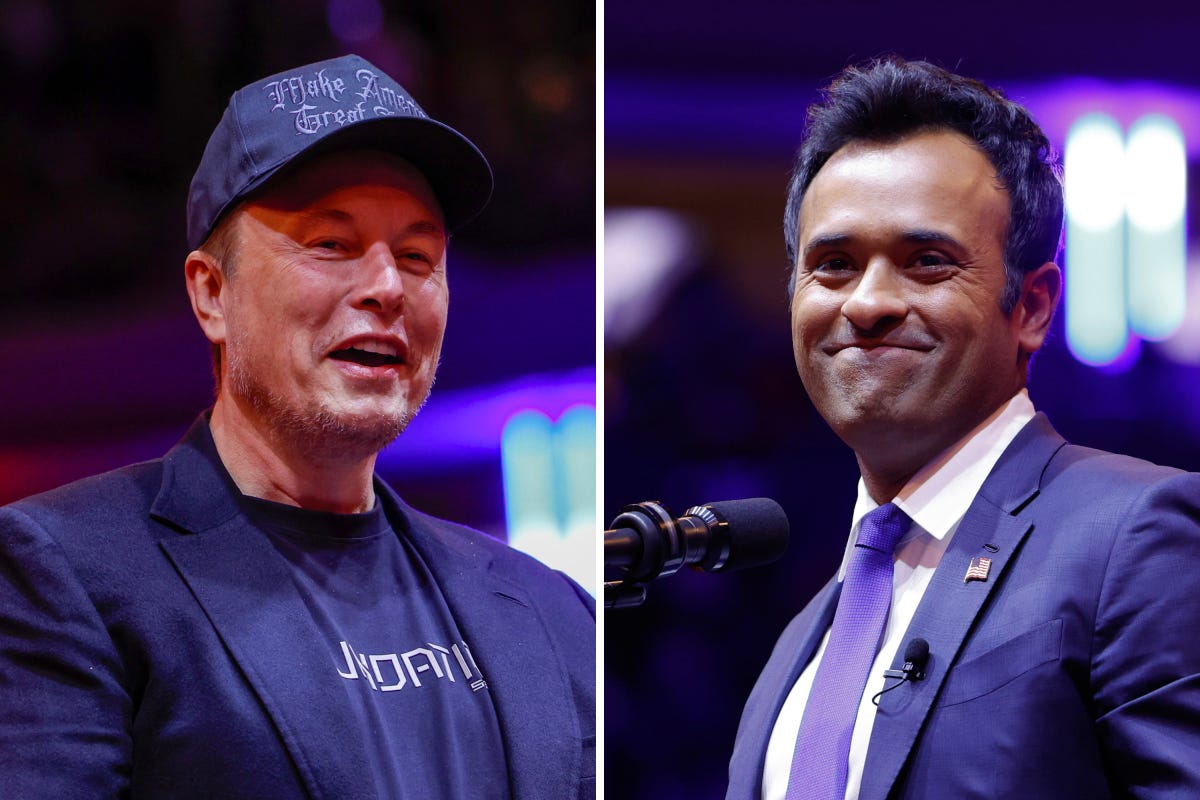

Image Source: Link

Summary: Elon Musk's diverse business empire, including Tesla, SpaceX, and Neuralink, stands to gain significantly from a Trump administration. SpaceX has already secured over $19 billion in federal contracts and is projected to earn billions more annually in the coming years. Musk, alongside Vivek Ramaswamy, is set to lead Trump's Department of Government Efficiency (DOGE), focusing on deregulation, administrative cuts, and cost savings. They advocate for rescinding Non-Congressional regulations and auditing federal agencies. Critics argue that reduced oversight and deregulation could particularly benefit Musk's ventures by loosening constraints on innovation and operations.

Consumer Analysis: From a consumer perspective, Elon Musk's ventures benefiting from deregulation and federal support could lead to mixed outcomes. On one hand, reduced regulatory constraints might accelerate innovation, potentially resulting in faster deployment of technologies like autonomous vehicles, advanced AI, and space exploration. This could enhance consumer access to cutting-edge products and services at potentially lower costs.

On the other hand, less oversight might raise concerns about safety, ethics, and accountability, particularly in industries like AI and aerospace. For consumers, this underscores a trade-off between rapid technological progress and the safeguards needed to ensure quality, and fairness. The direction of these policies will likely shape the trust and satisfaction consumers place in Musk's products and their long-term impact.

Source: Musk’s slash government agencies and regulation benefit empire

Key Terms

Tariff – a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages.

Inflation - a measure of how quickly prices are increasing over time. Or, how fast money loses its purchasing power.

Purchasing power - the value of a currency expressed in terms of the number of goods or services that one unit of money can buy.

Consumer spending - total spending on final goods and services for personal or household use

Deregulation - the reduction or elimination of government power in an industry.

We’ve explored how current economic events affect us all. Stay tuned for more insights in next week’s newsletter!

Provide Feedback | Access past newsletters | Follow us on social media | Check out our website