Newsletter #9

Featuring stories about: climate disaster's impact on insurance, the US budget deficit, and more!

Dear Reader,

Welcome back to the ninth edition of The Economic Literacy Initiative Newsletter. As always, you will find insights on current economic events. We are back in 2025 and are excited to explain economic news to help your economic literacy journey. Please note that due to delays, these stories are from January and don't represent the current landscape of economic news. By next week, we will be up to date and ready to feed you the current news. Happy reading!

Rising Insurance Costs from Climate Disasters

Image Source: Link

Summary: A Treasury Department report highlights that climate-related disasters are significantly increasing home insurance costs, particularly in high-risk areas. Between 2018 and 2022, premiums in the top 20% of high-risk zip codes averaged $2,321, which is 82% higher than in low-risk areas. The period saw 84 disasters causing over $609 billion in damages, with insurance costs rising faster than inflation. Nonrenewal rates and claim amounts were notably higher in disaster-prone regions, like the Southeast and Southwest, reflecting the growing challenge for homeowners and insurers. The report urges the incoming presidential administration to address these rising costs.

Consumer Analysis: The surge in home insurance costs due to climate-related disasters has a direct impact on consumers, particularly those in high-risk areas. For homeowners in these regions, the significant increase in premiums—82% higher on average compared to low-risk areas—places a financial strain, making it more challenging to afford essential insurance coverage. Additionally, with higher non renewal rates and costly claims, consumers face increased difficulty in securing and maintaining insurance, leaving them vulnerable to future disasters. This growing financial burden may force some homeowners to reconsider their living situations or invest in mitigation efforts to lower premiums.

Source: CNBC

Biden Student Loan Forgiveness

Image Source: Link

Summary: The Biden administration announced the forgiveness of $4.5 billion in student debt for 261,000 borrowers who attended Ashford University, a now-defunct for-profit institution. Eligible borrowers studied at Ashford between 2009 and 2020. The relief follows a successful lawsuit by the California Department of Education, which accused Ashford of deceiving students with false information about costs and career prospects. The lawsuit led to a $20 million penalty against Ashford and its parent company, Zovio. Many students were misled about the institution’s accreditation, leading to unusable degrees and significant debt. This action is part of broader efforts by the Biden administration, which has forgiven over $183 billion in student debt for more than 5 million borrowers.

Consumer Analysis: The Biden administration’s $4.5 billion student debt forgiveness for former Ashford University students alleviates significant financial burdens for 261,000 borrowers misled by the institution’s false promises about costs and career outcomes. Many students were left with unmanageable debt for degrees that did not lead to suitable employment due to inadequate accreditation. This relief improves borrowers' financial stability, potentially enhancing their credit and freeing up income for essential needs. Additionally, it underscores increased regulatory efforts to protect students from deceptive practices, promoting a more secure and transparent educational environment.

Source: CNBC

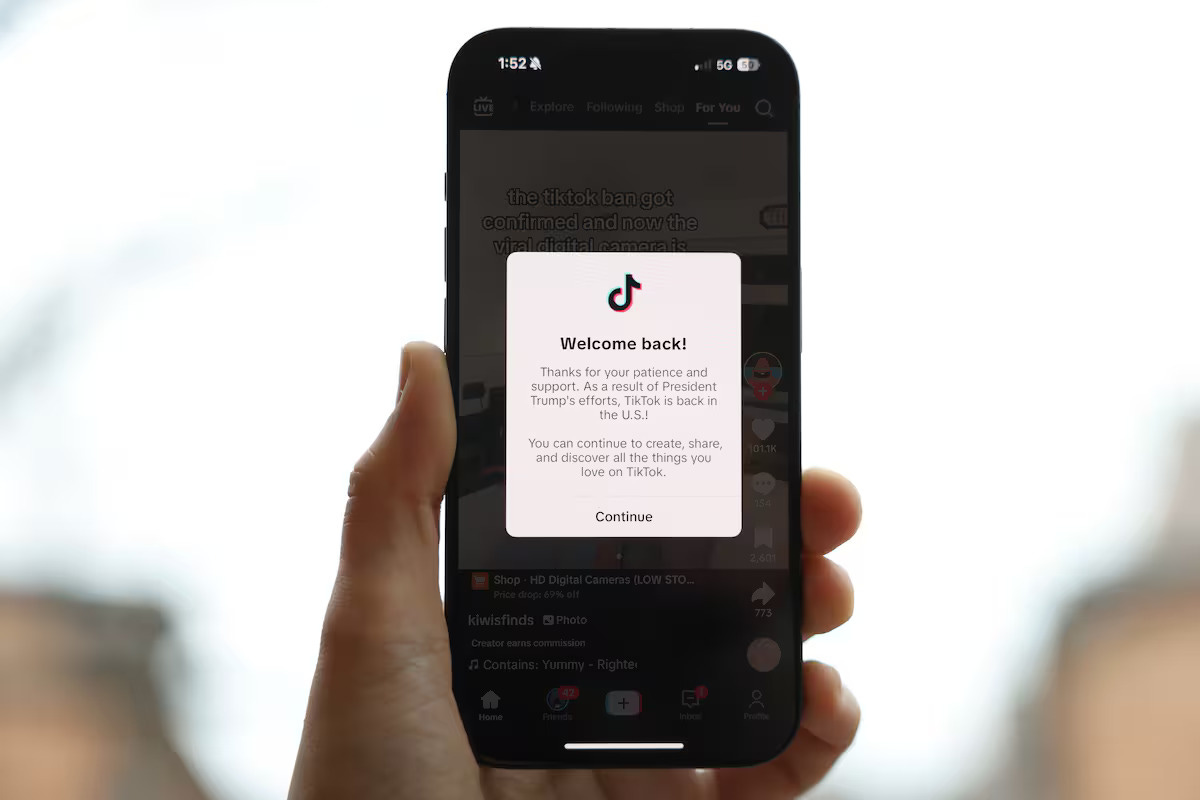

TikTok Restored Day After Ban

Image Source: Link

Summary: TikTok began restoring service to U.S. users after President-elect Donald Trump announced plans to delay a federal ban through an executive order, following his inauguration. The app had been temporarily unavailable after a Supreme Court ruling upheld the ban, which stemmed from concerns about ByteDance's Chinese ownership. TikTok expressed gratitude for Trump's assurances that service providers would not face penalties. While TikTok resumes U.S. operations, its long-term status remains uncertain as ByteDance has not agreed to divest the company.

Consumer Analysis: The recent restoration of TikTok's service in the U.S. after President-elect Trump's delay of the federal ban highlights the app's significant role in American digital life. Consumers, especially younger users and small businesses, rely heavily on TikTok for entertainment, social connection, and economic opportunities. The temporary shutdown and uncertainty surrounding TikTok's future may have caused anxiety and disrupted user engagement. However, the promise of ongoing access may reassure users and encourage continued interaction. TikTok’s commitment to resolving legal challenges suggests a consumer-focused approach, aiming to maintain its vast user base and support the digital economy.

Source: CNBC

Rising Inflation in December

Image Source: Link

Summary: In December 2024, U.S. inflation continued to rise, primarily driven by increased energy and food costs. The consumer price index (CPI) rose by 0.4% for the month, slightly above expectations, while the annual CPI reached 2.9%. Energy prices, especially gasoline, saw a significant 2.6% increase. Food costs also climbed by 0.3%, both in grocery stores and dining out. However, when food and energy prices were excluded, the core CPI rose by 3.2%, below the expected 3.3%. The report eased some concerns about persistent inflation, with the Federal Reserve expected to proceed cautiously in its interest rate cuts. Despite moderation in goods prices, costs in services like housing and eating out remain elevated. Additionally, the labor market showed strength with 256,000 jobs added in December, bolstering economic optimism ahead of the new administration's policies.

Consumer Analysis: Inflation is rising mainly due to higher energy and food costs, with prices up 2.9% annually. However, core inflation, excluding food and energy, was slightly lower than expected at 3.2%. Consumers are feeling the impact of rising gasoline and grocery prices, which are straining budgets. On the other hand, job growth is strong, which could help offset some of the inflationary pressure. While inflation in other goods is slowing, higher costs for essentials are still a challenge for consumers.

Source: US News

US Stock Market Rallies

Image Source: Link

Summary: U.S. stock indexes finished their best week in two months, with the S&P 500 rising 1%, the Dow Jones gaining 0.8%, and the Nasdaq climbing 1.5%. The rally was driven by strong performance in Big Tech stocks and positive earnings reports, particularly from oil services company SLB and banks like Truist Financial. Investors were also encouraged by better-than-expected inflation data, which raised hopes for further interest rate cuts by the Federal Reserve. However, uncertainty remains about the impact of potential economic policies under the new Trump administration, including tariffs and tax cuts.

Consumer Analysis: The recent stock market rally, driven by strong earnings and positive inflation data, could increase consumer confidence, leading to more spending as people feel more financially secure. Lower interest rates may encourage consumers to make big-ticket purchases, while easing energy prices could free up disposable income. The continued strength of the labor market and wage growth further supports consumer spending. Uncertainties about future economic policies under the new administration, such as tariffs or tax cuts, might make consumers more cautious and cause a balance between optimism with concerns about inflation.

Source: US News

Rising Federal Budget Deficit

Image Source: Link

Summary: In December 2024, the U.S. federal budget deficit increased by nearly 40% compared to the previous year, reaching a total of $710.9 billion for the first quarter of fiscal year 2025. This was driven by rising financing costs, continued growth in government spending, and declining tax revenues. Although the December deficit was $86.7 billion—33% lower than the same month in 2023—the overall budget shortfall ballooned due to a 7% rise in interest payments on the national debt, which now exceeds $36 trillion. The government's spending on debt interest surpassed other major expenses like Social Security, defense, and healthcare.

Consumer Analysis: The rising U.S. budget deficit and national debt could lead to higher borrowing costs for consumers, especially if interest rates continue to rise. Increased government borrowing typically puts upward pressure on interest rates, making loans, mortgages, and credit more expensive. Additionally, if the government reduces spending or raises taxes to manage the deficit, consumers may experience less disposable income. Moreover, the government's growing debt obligations could limit resources available for public services, impacting consumers' access to benefits like health care and education. Ultimately, these fiscal challenges may squeeze household budgets, particularly for those dependent on government support programs.

Source: CNBC

Key Terms

Insurance Premiums - the amount of money an individual or business pays for an insurance policy.

Inflation - a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time.

Consumer Price Index(CPI) - measures the monthly change in prices paid by U.S. consumers

S&P 500 - is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

Dow Jones - is one way of measuring the stock market's overall direction, and includes the prices of 30 of the most actively traded stocks.

Nasdaq - a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange, and is weighted toward the tech sector.

Budget Deficit - when government expenses exceed revenue.

Source: Investopedia

We’ve explored how current economic events affect us all. Stay tuned for more insights in next week’s newsletter!

Provide Feedback | Access past newsletters | Follow us on social media | Check out our website